Is Allowance for Doubtful Accounts a Temporary Account

Purchases returns and allowances. Permanent account so its balance carries forward to the next accounting period B.

Allowance For Uncollectible Accounts Personal Accounting

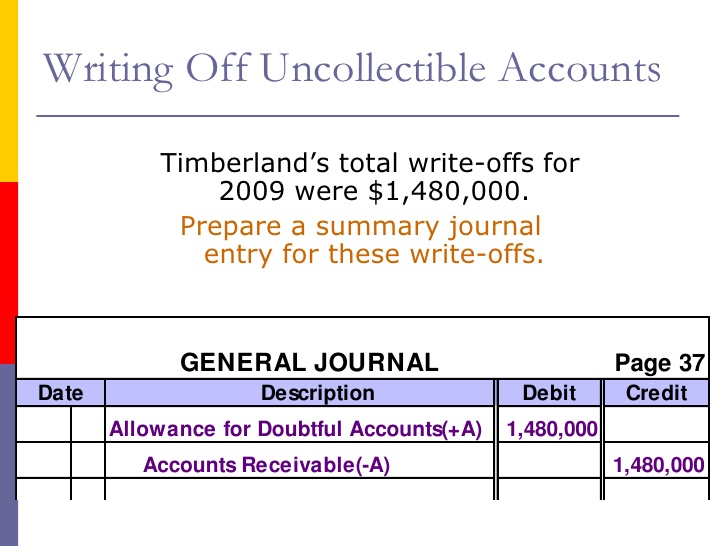

Allowance for doubtful accounts on December 31 1500 x 3 800 x 10 1200 x 20 1050 x 50 890.

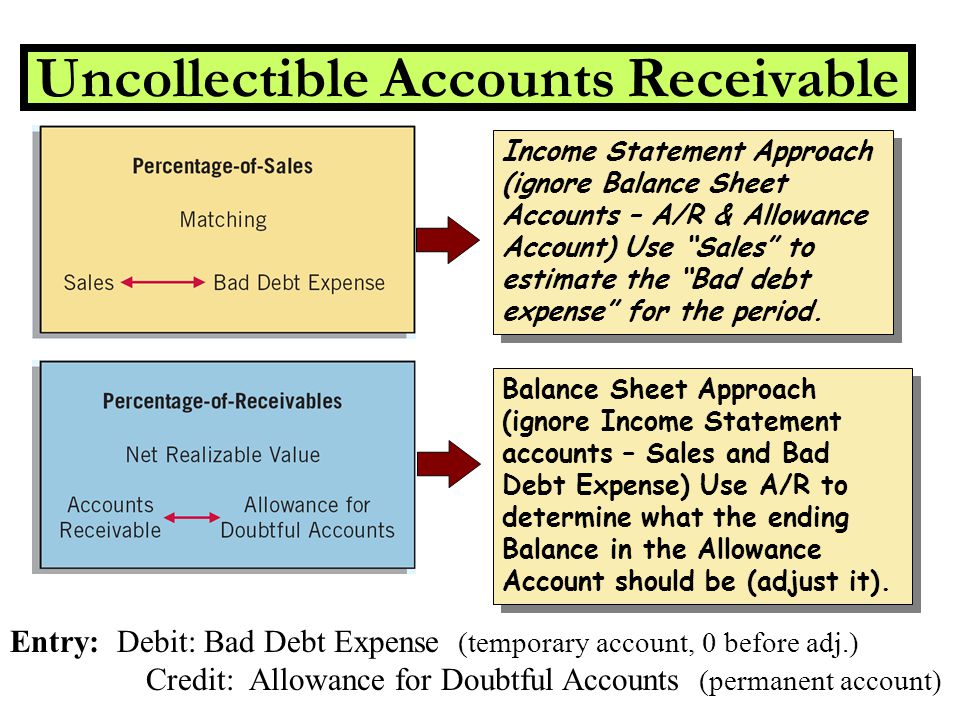

. Allowance for doubtful accounts. Suppose the business has a total of 100000 as accounts receivables and the company estimates that 10000 will go as uncollectible so this 10000 they need to account as the allowance. Only temporary accounts View the full answer Transcribed image text.

Credit to Allowance for Doubtful Accounts of 1100 c. Which of the following is a temporary account. Purchases returns and allowances.

The journal entry goes as follows where a debit entry is made against the bad debt expense and a credit entry is passed as an allowance for doubtful accounts. Discount on bonds payable C. Allowance for Doubtful Accounts is a.

Permanent and not closed at the end of the year. Select all that apply a. The Allowance for Doubtful Accounts Accounts is a temporary account which is closed to Retained Earnings at the end of the accounting period.

Likewise the normal balance of the allowance for doubtful accounts is on the credit side. This deduction is classified as a contra asset account. The allowance for doubtful accounts is a reduction of the total amount of accounts receivable appearing on a companys balance sheet and is listed as a deduction immediately below the accounts receivable line item.

The Allowance for Doubtful Accounts is a permanent account so its balance carries forward from one accounting period to the next. The allowance for doubtful accounts is a contra account to the accounts receivable on the balance sheet. Temporary account so its balance is closed zeroed out at the end of the accounting periodD.

Subtracting ALLOWANCE FOR DOUBTFUL ACCOUNTS from its ACCOUNTS RECEIVABLE. The Allowance for Doubtful Accounts account is a temporary account which is closed to Retained Earnings at the end of the accounting period. An allowance for doubtful accounts is considered a contra asset because it reduces the amount of an asset in this case the accounts receivable.

Hence the allowance for doubtful accounts increase by 390 890 500 during the accounting period. Allowance for Doubtful Accounts is a temporary account that is zeroed out at the end of each accounting period. The allowance sometimes called a bad debt reserve represents managements estimate of the amount of accounts receivable that will not be paid by customers.

True of False Expert Answer. Bad Debts Expense and Allowance for Doubtful Accounts are both permanent accounts and neither are closed at the end of the fiscal period. Example of Adjusting the Allowance for Doubtful Accounts The balance in the account Allowance for Doubtful Accounts should be the estimated amount of the companys receivables that will not be turning to cash.

In this case we can determine the allowance for doubtful accounts with the calculation as below. Allowance for doubtful accounts is a a permanent. The allowance for doubtful accounts also known as the allowance for uncollectible accounts is a contra-asset account linked to accounts receivable that serve to reflect the true worth of those accountsIt calculates the percentage of receivables that are likely to be uncollectible.

Expert Answer Answer E Dividend Distributed is a Temporary Account. What is the Allowance for Doubtful Accounts. Because dividend distributed Account are closed each year into Retained Earning and carried forward in.

Is ALLOWANCE FOR DOUBTFUL ACCOUNTS temporary or permanent. The Allowance for Doubtful Accounts account is a temporary account which is closed to Retained Earnings at the end of the accounting period. Bad Debts Expense and Allowance for Doubtful Accounts are both permanent accounts and neither are closed at the end of the fiscal period.

The adjusting entry to record estimated bad debts includes a _____. Permanent account so its balance is closed zeroed out at the end of the accounting period temporary account so Its balance carries forward to the next accounting period temporary account so its balance is closed zeroed out at the end of the accounting period permanent account so its balance carries forward to the. Bad Debts Expense is a permanent account and remains open at the end of the fiscal period while Allowance for Doubtful Accounts is a temporary account and is closed at the end of the fiscal period.

Hence the journal entry for uncollectible accounts will increase the total expenses on the income statement while decreasing the total assets on the. Allowance for doubtful accounts B. Companies allow and serves to reflect the true value of.

The allowance for doubtful accounts is a contra-asset account that is associated with accounts receivable Accounts Receivable Accounts Receivable AR represents the credit sales of a business which have not yet been collected from its customers. Debit to Bad Debt Expense of 1000 d. The Allowance for Doubtful Accounts has a 100 unadjusted debit balance.

Accounting Allowance for Doubtful Accounts is a. Which of the following is a temporary account. If actual experience differs then management adjusts its estimation.

Debit to Bad Debt Expense of 900. Permanent account so its balance is closed zeroed out at the end of the accounting periodC. Debit to Bad Debt Expense of 1100 b.

Bad Debts Expense is a temporary account and is closed at the end of the fiscal period while Allowance for Doubtful Accounts is a permanent account and remains open at the end of the fiscal period. Under the allowance method NET REALIZABLE VALUE is calculated by subtracting what accounts. For example if the Allowance for Doubtful Accounts presently has a credit balance of 2000 and you believe there is a total of 2900.

Notwithstanding the real installment conduct of clients may contrast significantly from the.

Allowance For Doubtful Accounts Purpose And Examples

Allowance For Doubtful Accounts Definition

Allowance For Uncollectible Accounts Personal Accounting

Which Accounts Are Affected And Not Affected By Closing Entries P S Of Marketing Accounting Books Accounting

Comments

Post a Comment